By Giovanni Emephia

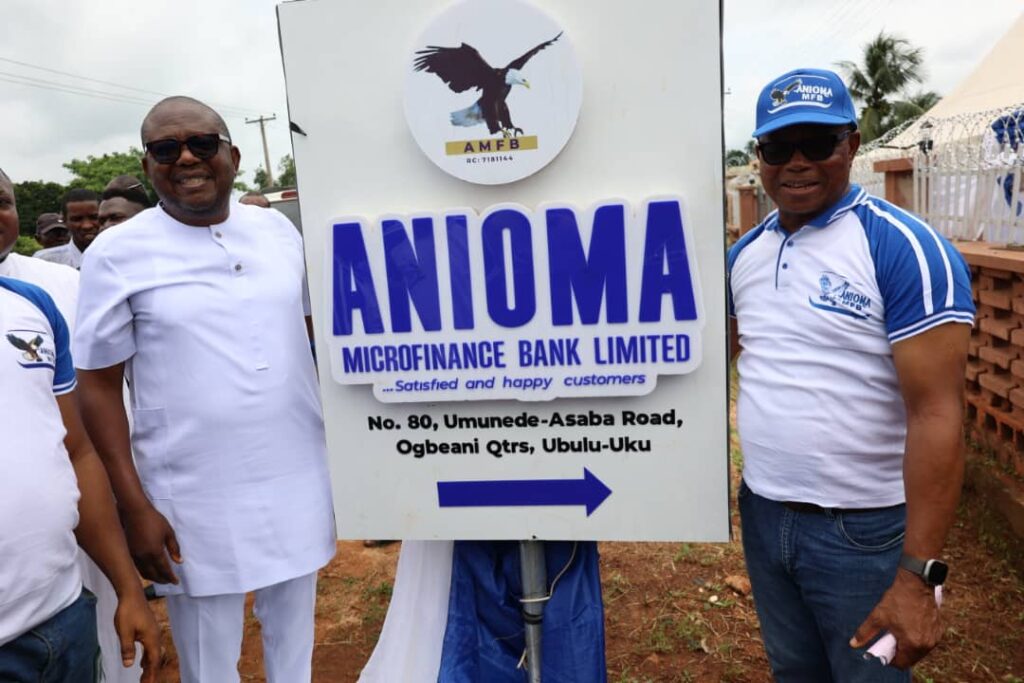

As part of efforts to promote meaningful economic development across the state, the serene community of Ubulu-Uku in Aniocha South Local Government Area of Delta State, Monday, received a major boost to the economy of the area with the inauguration of the Anioma Microfinance Bank Limited.

Performing the inauguration at Ubulu-Uku, Delta State Commissioner for Information, Dr. Ifeanyi Osuoza stated that the Anioma Microfinance Bank came at an opportune time when indigenes of the community and surrounding areas were yearning for investments that could attract development to the area and improve the fortunes of the people.

Osuoza stated that the establishment of the bank would provide the people a much-needed alternative to avail themselves of seamless banking services which they could hitherto enjoy only when they traveled to nearby urban centres.

The Commissioner commended those behind the establishment of the bank, describing their pledge of providing professional and comprehensive banking services as both timely and refreshing.

Dr. Osuoza further expressed hope that the bank would be able to deliver on its pledge of top-end banking services and a satisfied customer base.

The Commissioner urged other well-placed individuals across the state to complement the efforts of the state government by attracting viable investments to their communities that would boost the local economies and support the fulfilment of the MORE Agenda of the Oborevwori administration.

Speaking earlier, a retired director of research at the Central Bank of Nigeria and chairman of the Board of Directors of Anioma Microfinance Bank, Mr. Charles Mordi, stated that the difficulty in attracting an existing bank to the area was one factor that necessitated the establishment of the Microfinance bank.

Mordi revealed that bringing development to Ubulu-Uku and giving financial empowerment to the people of the area were the major considerations for establishing of the bank.

“By the time the bank stands on a solid foundation, we would be able to give credit. With the nature of business around, we have mainly artisans, farmers and so on. Some of them require credit to boost their businesses.”

While stressing the need to ‘bank the unbanked’ and bring financial inclusion to the people of the area, Mordi said that the bank would start as a digital bank and its ATM cards would be used universally.

GIPHY App Key not set. Please check settings