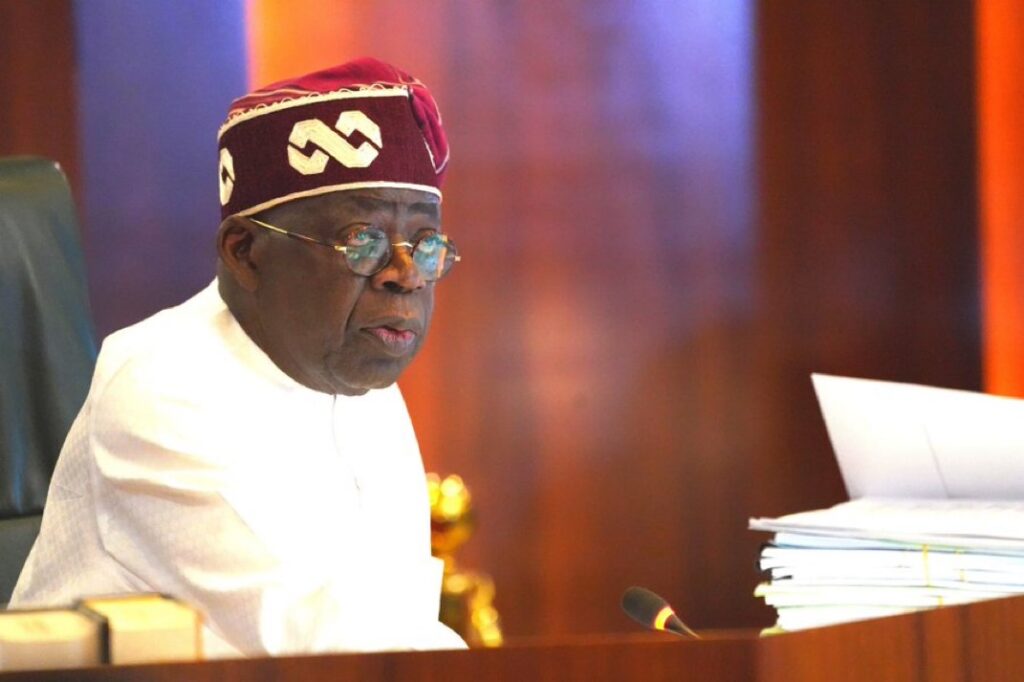

President Bola Ahmed Tinubu has approved the establishment of a National Tax Policy Implementation Committee (NTPIC), a major step toward executing the administration’s sweeping tax reforms aimed at strengthening public finance and stimulating economic growth.

The committee will be chaired by veteran financial expert Joseph Tegbe, a Fellow of both the Institute of Chartered Accountants of Nigeria (ICAN) and the Chartered Institute of Taxation of Nigeria (CITN), with more than 35 years of professional experience, including his role as Senior Partner and Head of Advisory Services at KPMG Africa. The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, will oversee the Committee’s activities, while Mrs Sanyade Okoli, Special Adviser to the President on Finance and Economy, will serve as Secretary.

Other members include Ismaeel Ahmed, Rukaiya El-Rufai, and several experts drawn from tax administration, finance, law, the private sector, and civil society.

According to a State House statement issued by Presidential Adviser on Information and Strategy, Bayo Onanuga, the President emphasised that the effective implementation of new tax laws is central to the government’s economic transformation agenda.

“These new Tax Acts reflect our administration’s commitment to building a fair, transparent, and technology-driven tax system that supports economic growth while protecting the interests of citizens and businesses,” President Tinubu said.

He added that the NTPIC would ensure “coherent, effective, and well-aligned implementation across all levels of government.”

Mandate of the Committee

The NTPIC is charged with coordinating nationwide stakeholder consultations, engaging the private sector, professional bodies, and subnational governments to gather broad-based input for smooth implementation of the new tax laws. It will also run extensive public awareness campaigns to aid understanding and compliance.

The committee’s work will prioritise enhanced inter-agency coordination by harmonising existing tax frameworks with new statutes, aligning revenue-generating and regulatory institutions, and ensuring unified oversight and reporting during the transition.

The government expects the Committee’s efforts to improve revenue mobilisation, curb leakages, enhance accountability, and strengthen fiscal sustainability as part of Nigeria’s broader national development goals.

Reactions from Key Officials

Tegbe expressed confidence in the Committee’s capacity to deliver:

“We understand the strategic importance of these Tax Acts. Our committee will work closely with all stakeholders to support the Minister of Finance in ensuring seamless implementation and building public trust in the tax system.”

Wale Edun said the President had provided “the direction, authority, and support required to reset not just the tax system but the entire fiscal policy framework of government,” positioning the reforms to drive significant economic growth.

The Committee is expected to begin work immediately.

GIPHY App Key not set. Please check settings